Bitcoin Is Truly the Only Scarce Commodity on Earth

Monetary inflation is a silent assassination that kills your purchasing power slowly but surely.

The current system is flawed and not fixable.

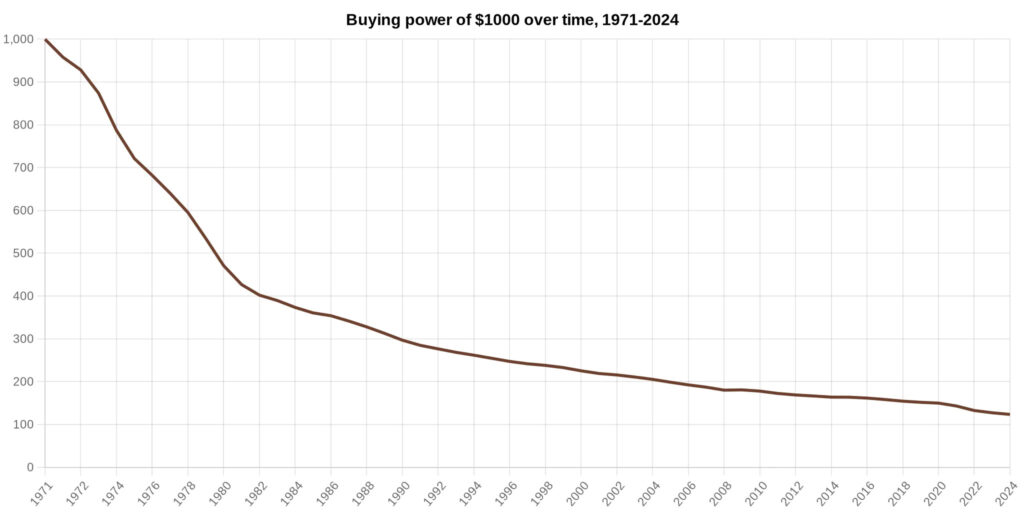

$1,000 in 1971 will only represent a purchasing power of $123 in 2024:

In 53 years, the purchasing power of the US dollar has dropped by -87.7%. This is abominable!

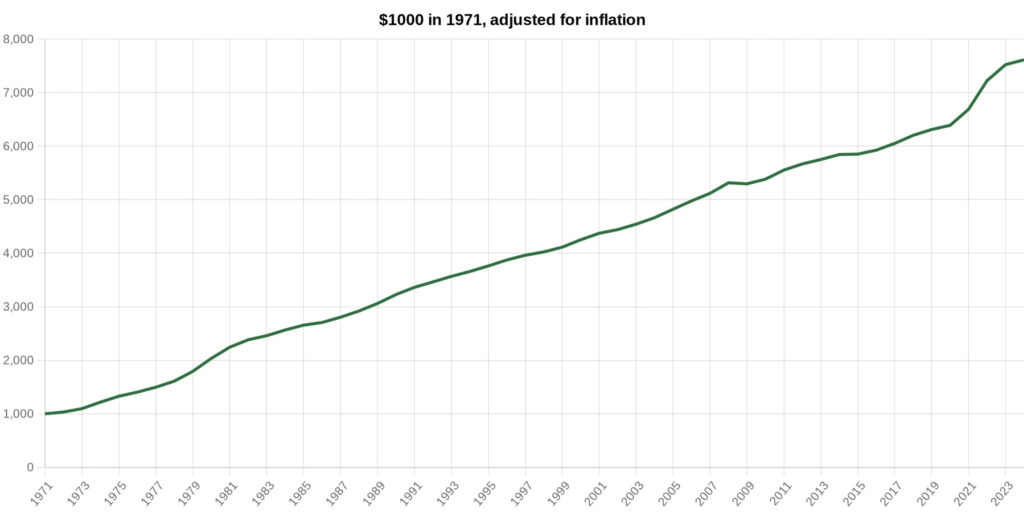

To simply maintain your purchasing power, you would have had to find an investment that would allow you to transform that $1,000 from 1971 into $7,615:

Investments that can turn $1,000 into $7,615 in 52 years do exist.

However, they are not available to those who need them most, and more importantly, why would you need to make investments, and therefore take risks, when you would simply like to maintain your purchasing power without risk by using your fundamental right to saving the fruits of your labor?

Under the current system, this is impossible.

If you decide to save the fruits of your labor in a bank account, you will let inflation impoverish you silently, while putting the fruits of your labor in the hands of a third party who will take control of them and may confiscate them for totally arbitrary reasons.

So you will have to invest.

The do-gooders of the current system will tell you that there is no lack of options:

- Real estate.

- Shares on the stock market.

- Bonds to bet on the American dollar.

- Gold.

- …

I stop here because these are the most common investments. Other more complex products exist, but the problem is the same, as you will see.

By buying real estate, you will think that you own something that is yours and that is rare. So it should increase in value over time.

This is a possibility, but you still have two risks: the risk of confiscation by the State for arbitrary reasons, and the risk that developers will come and build more real estate right next to yours, making it less rare, and thus lowering its value.

Not ideal, you will agree.

So you can go to the stock market. Warren Buffett keeps telling you how great it is… You will fall into a manipulated market where your shareholding can be diluted at any time if the founders want to issue more shares.

You probably won’t have a say at your level!

Not ideal, still.

For those who want to bet on the US dollar or other fiat currencies, I don’t know what to tell you… The constant debasement of these fiat currencies should be enough to dissuade you, but some people are still under the illusion of the current system.

Central bankers can print so much fiat money out of thin air as you have seen even more blatantly in the last few months.

Next option then.

Gold has been the benchmark reserve asset for centuries.

Gold apparently exists in finite quantities on Earth. So that’s a good thing. The problem is that sometimes new veins are found and gold extraction is increased, putting more gold on the market, which will play negatively on its price.

With equal demand, more supply means a lower price.

Then, we can recall the different problems of gold in the digital world of tomorrow: problems of transport, confiscation, or storage.

So let’s leave this option aside again.

What’s left for you?

You have the only truly scarce commodity left on earth: Bitcoin!

Bitcoin is hard-capped at 21 million units. No matter what. You can see for yourself in the Bitcoin source code. No one will be able to change it unless the majority decides to do so, but that won’t happen, because no one has an interest in it.

So Bitcoin is hard for some to understand because it’s the first time you have an asset that belongs to you (once you take possession of your private keys) and can’t be debased.

Time is clearly on Bitcoin’s side and more and more people will come to realize what Bitcoin brings to the world of today and tomorrow.

It’s up to you to take advantage of it before anyone else does 🙂